Student Loans & The Hard Truth About College

Student loan payments are back, and they’re hitting hard. As of May 5, 2025, the Department of Education has begun collecting on defaulted loans for the first time since March 2020. Who could have guessed…?

On a recent Dad Saves America episode, I broke down the mess of 43 million borrowers who collectively owe $1.6 trillion, 62% of whom haven’t been paying a dime. Wages will be garnished, tax refunds will be seized, and this is about to get very serious for some folks. But the real scandal is that Americans have been sold an expensive lie—that college is a golden ticket you can and should finance without any concern for the future bill.

Former President Joe Biden tried to “forgive” loans, calling it “debt relief.”

Sounds nice, except that it’s not debt relief—it’s more of a wealth transfer.

Debt can’t be erased when the lender is financing their own debts, just like you. What actually happens? The debt gets shifted to someone else.

Grandma’s Treasury bonds, your taxes, my paycheck—we’re the ones paying when borrowers walk away. A third of these borrowers didn’t even finish college, getting zero benefit but all the debt.

Bryan Caplan’s research nails it when he points out that no degree = no income boost. Just a hole in your wallet. Student debt is bad enough when you graduate, but if you go to college to “find yourself” and find that you’re not that interested, you’re in for a bad time financially.

Why Is College So Expensive?

Well, it’s not because professors suddenly got pricier due to increased wisdom.

Over 40 years, public university costs tripled, while Pell Grants dropped from covering 80% to 32% of tuition. The government is quite obviously to blame. Since 2010, they’ve owned 92% of student loans, thanks to Obamacare’s sneaky Healthcare and Education Reconciliation Act. The result was that debt doubled from $811 billion to $1.74 trillion by 2022. Easy federal loans allowed colleges to jack up prices, knowing that taxpayers would foot the bill.

Imagine your teenager is about to get their first car. They are going to pick very different vehicles if given the option of Mom and Dad covering 60% of whatever car they want vs only spending what they’d saved by age 16.

In the first scenario, prepare to finance a Tesla for your teenager. And if the car dealership knows that Mommy and Daddy are standing behind you with an open checkbook, you can count on them bargaining upward (not down) on the car lot.

William Bennett called it in 1987 when he determined that more financial aid = higher tuition. It’s basic economics.

From 2004 to 2023, Harvard’s administration grew by 43%, while general faculty crept up by 11%. Across other universities, admin staff doubled from 1987 to 2012, while full-time professors shrank. Administrative bloat is the real driving force behind the cost explosion, not access to world-class educators.

We’re paying for bureaucrats, not teachers.

An Honest-To-Goodness Scam

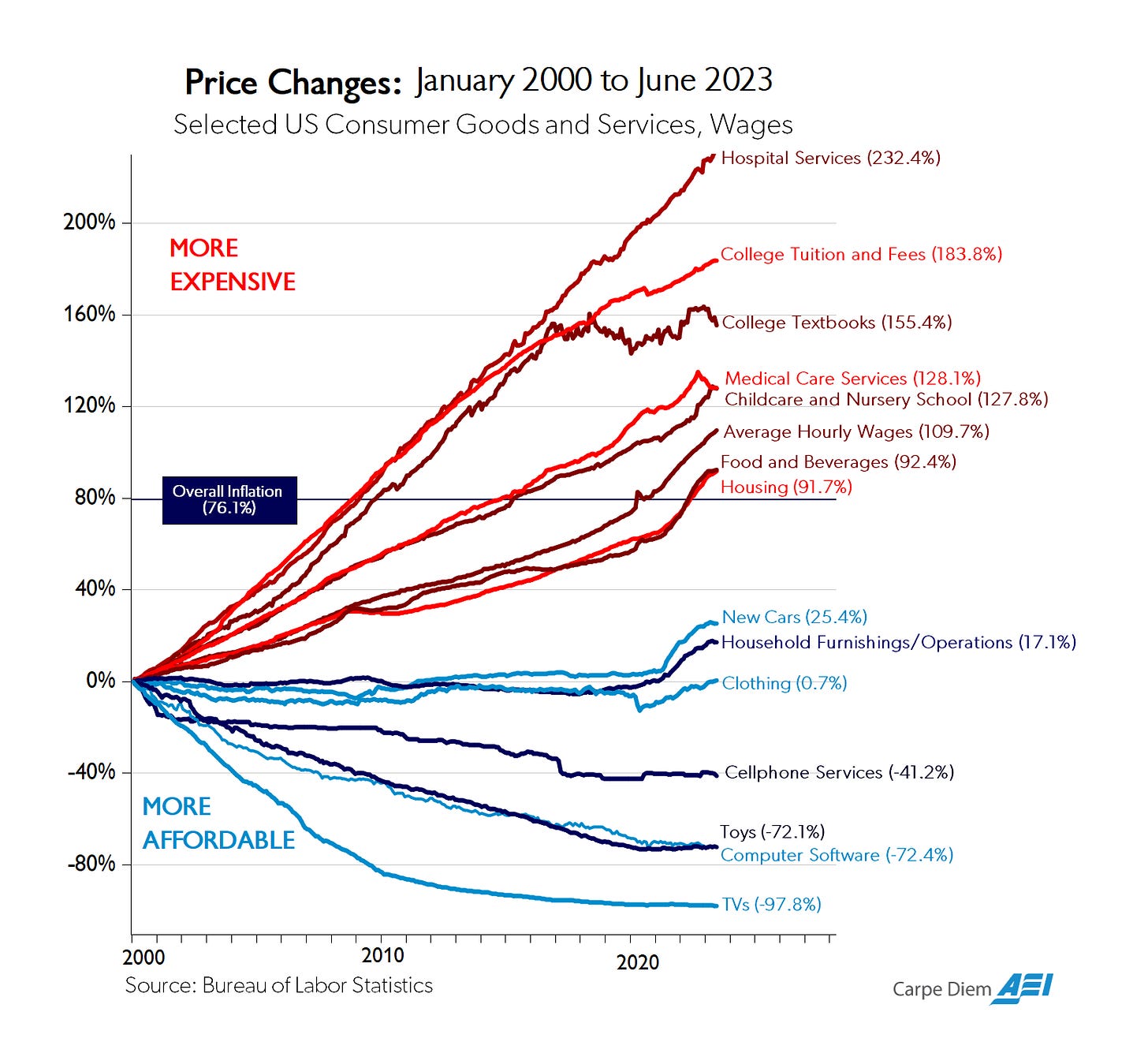

Obama blamed “bankers” and “middlemen” for the loan crisis, but the real special interest is universities. They lobby (hard) for taxpayer-backed loans, knowing full well that they can charge whatever they want. Mark Perry’s graph tells the story: since 2000, college tuition is up 184%, textbooks are up 155%, while TVs, phones, and computers have plummeted.

Why? Markets, markets, markets! Competition drives prices down—unless the government pumps in cheap credit (subsidies). Housing is the same—30-year mortgages exist because of federal meddling, inflating prices beyond reason.

Obama-style narratives of corporate and financier greed make no sense when you face the facts presented in that chart. The world’s most cutting-edge technologies keep getting cheaper, while college textbooks somehow have gotten more expensive… think about that.

Loan forgiveness is a vote-buying scam. It screws taxpayers, rewards deadbeats, and punishes those who’ve paid off their loans, making them suckers. Worse, it tells kids to borrow recklessly—why care if Uncle Sam might one day cancel it? That’s why colleges keep hiking tuition, and we’re left holding the bag.

Parents, Take the Wheel, Please!

Milton Friedman said it best… “There’s no such thing as a free lunch.” Someone’s paying, always.

As parents, we can’t fix this crony mess, but we can stop buying the lie and reselling it over the dinner table. Don’t push your kid into a $200,000 gender studies degree. Talk trade schools, community colleges, or STEM fields with real jobs at the end of the experience.

Teach your kids to engage with these questions: Is this degree worth the debt? Will it deliver based on the best available evidence?

The Trump administration is bringing back loan payments, and I’m glad. It’s a start. But we need major changes to how the government handles higher education, preferably getting out of student loans entirely.

Let banks set rates based on risk: 45% for fluffy majors, 2% for computer science. Market prices will force colleges to cut costs or die.

This $1.6 trillion disaster should be a wake-up call.

Sit your kids down. Ask, “What’s your plan to avoid drowning in debt?”

Not a fun conversation by any means, but asking these questions now can save you a whole lot of time, money, and headaches later.

When a friend boasted about his loans being forgiven, I had to plead with him to never mention it in front of me again. He tried to justify it by saying his loan was from Navient. Well, MY loan had eventually migrated to Navient. I paid it off in 2021 after years of living on the edge (and graduating in 1994).

That Biden did this just burned in my gut. It absolutely made suckers of those of us who sacrificed to honor our loans. Worse, the income cap was way too high -- was it nearly 200 grand per household???? If I'd been making 100 grand, I could have paid off my loan in one year!

Reinstating these debts is the right thing to do!

Great column. I remember well Obama telling everyone that college was too expensive because of greedy corporations. That once the govt took over student loans, things would be much cheaper and equitable. He was right. Now everyone is poor